In our first issue of Founder Leverage, we map OpenAI’s fundraising rounds to know where and how it used this money to achieve its current enterprise success.

Great companies don’t raise money to survive.

They raise money to change the rules of the game.

OpenAI’s funding history is often described as “massive” or “unfairly advantaged.”

That misses the real story. Because, capital doesn’t scale companies. It scales the consequences of the choices you’ve already made.

From a nonprofit ambition to a multibillion-dollar private powerhouse, each major round didn’t just put more money in the bank. It rewired the incentives of OpenAI founders, investors, and strategic partners.

This issue analyzes how each major funding phase changed OpenAI’s incentives, constraints, and bargaining power — and what founders can concretely do once they understand those mechanics.

It’s a case study in how capital, timing, and strategic alignment can compound leverage over time.

On Founder Leverage, we don’t share a funding recap. Get quick and actionable analysis of how capital changes leverage for companies — and what founders can do about it.

Shared once a month:

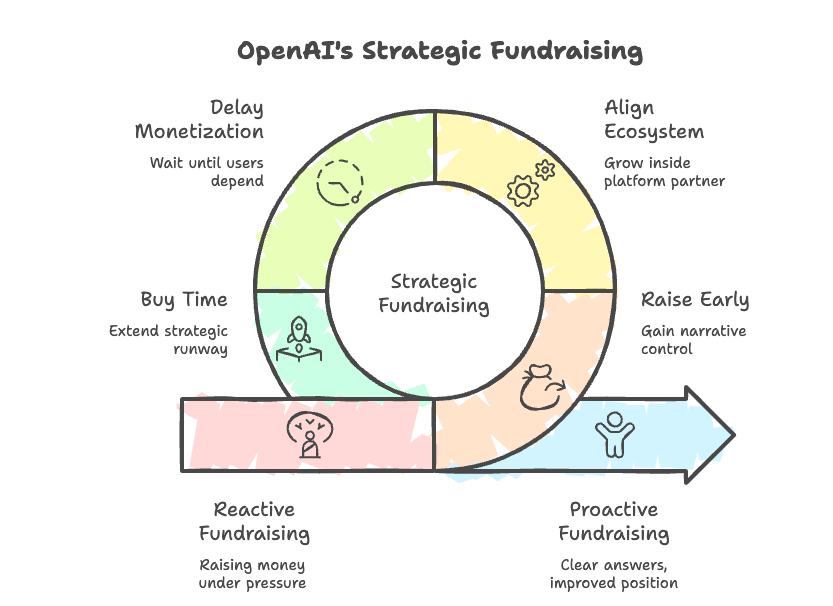

The core fundraising strategy played by OpenAI

OpenAI didn’t raise money to build features. They raised money to reshape incentives, timelines, and power dynamics.

Most founders think of fundraising as fuel for daily operations.

OpenAI treated fundraising as a structural tool:

- to buy time

- to control incentives

- to choose dependencies intentionally

- to delay monetization until leverage peaked

That difference matters.

OpenAI funding rounds × Subsequent feature developments

Based on secondary research, here’s what I have compiled about OpenAI’s full funding rounds from pre-seed in 2016 to 2026:

| Funding Round | Date | Amount & Lead Investors | Subsequent Capabilities / Releases | Strategic Impact |

|---|---|---|---|---|

| Pre-Seed / Early Research | 2016 | ~$120K (Y Combinator + angels) | Foundation research on GPT/early transformer models | Built core technical base for large language models; early capability before productization |

| Microsoft Corporate Round | Jul 2019 | $1B (Microsoft-led) | GPT-2 expansion → groundwork toward GPT-3 | Shift from nonprofit research to scaled compute-backed capabilities; enterprise credibility increased |

| Microsoft Corporate / Extended Support | Jan 2023 | $10B (Microsoft) | ChatGPT launch → integration with Azure / Bing | Rapid user growth and broad deployment; foundational product-market fit phase |

| Secondary & Early Venture Rounds | Apr 2023 | ~$300M (secondary) | Enhanced infrastructure to support increasing traffic | Liquidity and backing by VCs signaled broader institutional confidence |

| Series D / Major Venture | Oct 2024 | $6.6B (Thrive, SoftBank, Microsoft, others) | Significant upgrades to GPT-4 / enterprise API expansion | Capability expansion toward enterprise reliability and scaling beyond consumer layer |

| SoftBank / Strategic Capital | Mar 2025 | ~$40B (SoftBank-led) | Push toward GPT-o / multimodal models; infrastructure projects | Platform leap — multimodal AI, deeper ecosystem integration, broader enterprise and partner reach |

| 2025 Secondary / Ongoing Funding | 2025 | ~$6.6B resale + ongoing investor activity | New models (o3, o4-mini), expanded compute deals | Expanded product family and diversification of capabilities, including smaller reasoning models |

Funding didn’t cause innovation — it removed constraints at the right moments.

Patterns in OpenAI’s fundraising trajectory so far

🔎 Pattern 1 — From research to deployment

OpenAI’s earliest capital (pre-seed through 2019) didn’t aim at features — it built technical capacity. The Microsoft capital in 2019 was less about product rollout. It focused more on ensuring long-horizon compute resources. This included cloud backing, which later made GPT-3 and ChatGPT feasible at scale.

🔎 Pattern 2 — Strategic capital unlocks scale, not just code

The $6.6B round in late 2024 coincided with stable enterprise API support and reliability improvements — not just more parameter counting. This is capital translating into enterprise-grade capabilities rather than headlines.

🔎 Pattern 3 — Mega capital = Platform leverage

The ~$40B round and associated strategic deals in 2025 correlate with structural expansions:

- multimodal models,

- deeper enterprise integrations,

- compute ecosystem projects

Capital here did not just pay for features. It reshaped routes to adoption and partner lock-in.

🔎 Pattern 4 — Broadening the model family

Later parts of 2025 saw O-series releases (o3, o4-mini). These releases show an expansion of the capability spectrum. They range from base models to more niche, efficient next-gen models. The models serve different use cases and tiers of users.

Capital unlocked structural capability: first compute, then enterprise reliability, then ecosystem depth and model breadth.

That order matters — it tracked OpenAI’s shift from research artifact → product → platform.

We can understand their funding in different phases as follows:

| Funding Phase | Strategic Shift Enabled | What Actually Changed |

|---|---|---|

| Early research | Talent and time | Ability to attract elite researchers without commercial pressure |

| Microsoft partnership | Compute + distribution | Access to large-scale infrastructure + enterprise credibility |

| Post-ChatGPT | Monetization leverage | Shift from research-first to platform-first |

| Recent strategic funding | Platform control | Expansion into APIs, enterprise, multimodal models |

Let’s understand each phase in detail:

Phase 1: Early research capital (Pre-commercial pressure)

What changed structurally for OpenAI:

- OpenAI removed the revenue clock

- Researchers optimized for long-term breakthroughs, not demos

- Hiring incentives favored depth over speed

Leverage created for OpenAI:

- Talent concentration became the moat

- Time became an asset, not a liability

What founders can learn from this:

If your company’s advantage depends on quality or depth, raise early enough to:

- eliminate short-term monetization pressure

- buy decision quality, not growth

👉 Action:

Raise your first round to remove one irreversible constraint (e.g., premature pricing, rushed GTM), not to ‘extend runway.’

Phase 2: Microsoft partnership capital

What changed structurally for OpenAI:

- Compute availability stopped being a bottleneck

- OpenAI gained enterprise-grade credibility overnight

- Distribution friction collapsed

This introduced dependency — but a chosen dependency.

Leverage created for OpenAI:

- Speed-to-scale advantage

- Platform legitimacy competitors couldn’t replicate quickly

What founders can learn from this:

Strategic dependence is dangerous only when accidental.

👉 Action:

If you take strategic capital:

- map exactly what you gain (infra, trust, channels)

- explicitly accept what you lose (flexibility, neutrality)

- make sure the trade-off accelerates your dominant path

If you can’t articulate this trade clearly, don’t take the money.

Phase 3: ChatGPT adoption → Post-product capital

What changed structurally for OpenAI

- Demand became visible before monetization

- Users adjusted workflows around OpenAI

- Switching costs emerged organically

Leverage created for OpenAI

- Pricing power without urgency

- Optionality across APIs, enterprise, and platform plays

What founders can learn from this

Monetization works best after behavior change, not before.

👉 Action:

Delay aggressive pricing until:

- usage is habitual

- alternatives feel worse, not just different

- your product becomes infrastructure in users’ minds

If you price too early, you cap leverage before it compounds.

Phase 4: Recent strategic capital (platform phase)

What changed structurally for OpenAI

- OpenAI stopped being “a model company”

- It became a platform allocator

- Ecosystem gravity formed (builders, enterprises, partners)

Leverage created for OpenAI

- Others build on top of OpenAI

- Competitive threats move slower than OpenAI’s roadmap

What founders can learn from this

Capital at scale should change your role in the ecosystem, not just your headcount.

👉 Action:

Ask before your next round:

- Does this capital move me from product → platform?

- Will others depend on me more after this raise?

If the answer is no, you’re likely just scaling effort, not leverage.

Capital → Capability map

OpenAI’s rounds show a repeatable pattern:

| Capital Bought | Capability Unlocked | Strategic Effect |

|---|---|---|

| Time | Better decisions | Fewer forced moves |

| Compute | Reliability | Enterprise trust |

| Credibility | Distribution | Faster adoption |

| Ecosystem | Dependency | Market control |

👉 Founder takeaway:

Never raise without knowing which ability you are purchasing.

What OpenAI did differently for its fundraising?

1. They raised before they ‘needed’ to

OpenAI raised capital ahead of clear monetization, not after.

This bought:

- narrative control

- longer experimentation cycles

- optionality

Most startups wait until pressure forces them to raise.

That’s when leverage is lowest.

Between 2023 and 2025, OpenAI’s rounds shifted from symbolic to industrial:

- A $6.6 billion round in 2024 pushed valuation to ~$157 billion, attracting a mix of venture firms and strategic tech partners.

- A $40 billion round in 2025 was led by SoftBank. It was supported by Microsoft and others. This vaulted OpenAI to a ~$300 billion valuation. It was one of the largest private tech deals ever.

These rounds didn’t just fuel growth. They explicitly positioned OpenAI as the center of the AI economy. This positioning enabled massive investments in compute, talent, and infrastructure. Competitors would struggle to match these investments.

Leverage gained:

- Scale in infrastructure and R&D

- Massive talent acquisition power

- Competitive lock-in via ecosystem effects (Azure, Nvidia, SoftBank networks)

2. They chose one powerful dependency (on purpose)

The Microsoft partnership wasn’t just about money.

OpenAI began in 2015 as a nonprofit with lofty AGI ambitions. Early commitments were symbolic — but inadequate to build a compute-heavy product. In 2019, Microsoft’s $1 billion investment provided more than cash. It anchored OpenAI’s capacity to scale models like GPT-3 and ensured Azure would host its training workloads. This took OpenAI out of insurgent-researcher status and tied it closely to one of the world’s largest cloud platforms.

It locked in:

- compute certainty

- enterprise trust

- go-to-market acceleration

Trade-off accepted: less independence

Reward gained: speed + scale

This was a game-theoretic move, not a convenience decision.

3. They delayed monetization until power was clear

OpenAI didn’t rush to sell APIs aggressively at first.

They waited until:

- demand was obvious

- usage was habitual

- switching costs had formed

By the time pricing arrived, the market had already adjusted around them.

How founders and operators can use the OpenAI fundraising playbook?

What OpenAI did → What you can do

- Raised capital before Product-Market fit pressure

→ Raise when you still have narrative control - Aligned deeply with one ecosystem

→ Pick a platform partner you can grow inside - Delayed aggressive monetization

→ Wait until users depend on you - Used funding to buy time, not features

→ Extend your strategic runway, not just burn

A practical checklist based on OpenAI’s fundraising journey

Before your next fundraise, ask yourself:

- What leverage does this investor give me beyond money?

- What constraint does this round remove?

- What dependency am I creating?

- What must be true 6 months after this round?

- Does this round improve my negotiation position later?

If you can’t answer these clearly, you’re raising reactively.

Investor lens: Why OpenAI was an attractive bet?

At different stages, OpenAI offered different signals:

- Early: talent density + research moat

- Mid: infrastructure defensibility + adoption velocity

- Later: platform gravity + revenue visibility

Good investors fund trajectory, not snapshots.

Hidden costs of fundraising – lessons from OpenAI funding journey

This approach doesn’t always work.

1. Incentives pulled from mission to execution

With early Microsoft capital, OpenAI had to translate research into commercial outputs. Research agendas that once prioritized open science shifted toward deployable models with monetization paths. The timeline for revenue growth and enterprise adoption began to outweigh purely exploratory goals.

2. Capital concentrates control behind fewer strategic players

SoftBank’s massive 2025 investment is significant. Microsoft’s continued deep involvement is also significant. The syndication of large strategic rounds means that decision-making power is concentrated among a few deep investors. This tends to centralize strategic influence and potentially constrain pivot options.

3. Infrastructure commitments lock in future costs

Investments tied to compute infrastructure, including rumored multi-billion data center projects, mean forward obligations that aren’t easily unwound. Capital that looks like optional fuel becomes a governance tool — with structural implications for how and where OpenAI operates.

4. OpenAI’s capital trajectory created a series of strategic constraints and forced moves

- Dependency on strategic infrastructure (Azure compute) means reduction in optionality — OpenAI must keep partner alignment.

- Massive valuations and public expectations shape what future boards and investors consider acceptable pivots.

- Capital depth as competitive moat: Competitors can raise lots of money. But matching OpenAI’s ecosystem of compute, partner networks, and strategic capital is far harder than matching pure funding.

In essence, capital didn’t just buy resources — it structured the competitive game in which OpenAI operates.

One question for capital allocators

Given what we know about how OpenAI’s capital shaped its incentives and partnerships, what level of strategic dependency on a single partner (like a cloud provider) is acceptable before optionality is effectively lost?

Watch out for:

- Strategic investors too early → loss of independence

- Infra partnerships without leverage → permanent lock-in

- Raising without a clear constraint to remove

Leverage only compounds if you choose dependencies consciously.

Subscribe to Founder Leverage monthly newsletter

Every funding round changes incentives. Founder Leverage newsletter shows you how to use that shift instead of fighting it.

I’m writing Founder Leverage for builders who want to think clearly under pressure.

Not every company needs to raise fast. Not every round increases leverage. And not every strategic partnership is worth the trade-off.

This newsletter breaks down those decisions — using real companies — so you can make fewer forced moves and better long-term bets.

If this resonates, you’re exactly who this is for.

Subscribe to get insights – only once a month:

Do reply with one item you’d add to improve this analysis.

Citations:

- OpenAI’s $40 billion round was one of the largest private tech deals in history. [CNBC]

- SoftBank deployed its investment in multiple tranches, reflecting long-term strategic commitment. [Fintool]

- OpenAI’s funding history spans multiple big rounds, including ~$6.6 billion in 2024 and $40 billion in 2025. [TexAu]

- The company’s valuation reached ~$500 billion after a large secondary sale in 2025. [Sacra]

- Reports indicate ongoing discussions for new capital influx from Nvidia, Amazon, etc., in 2026. [Financial Times]

.

.

.

.

OpenAI Funding FAQs Solved

How does OpenAI get money?

OpenAI generates revenue primarily through API licensing fees for its AI models to businesses. Subscriptions like ChatGPT Plus account for about 75% of revenue. They also have enterprise deals.

How much money OpenAI spent?

OpenAI spent over $8 billion in 2025 on R&D, servers, and operations, with H1 2025 alone seeing $6.7 billion on R&D and total expenditures projected at $115 billion through 2029.

Who finances OpenAI?

Key financiers include Microsoft (over $13 billion invested), SoftBank, Dragoneer, Thrive Capital, Sequoia, Andreessen Horowitz, and others like T. Rowe Price and Blackstone.

How to fund OpenAI?

OpenAI does not accept public investments; funding comes via private venture rounds led by institutional investors like SoftBank and Microsoft.

Who funded OpenAI initially?

OpenAI was initially funded in 2015 as a nonprofit. It received $1 billion from founders and donors. These included Elon Musk, Sam Altman, Reid Hoffman, Peter Thiel, and others.

Why does OpenAI lose money?

OpenAI loses money due to massive costs. These costs include AI training, Nvidia servers/compute (projected $450 billion by 2030), R&D hiring, stock compensation, and infrastructure. The expenses are outpacing revenue growth.

Who funded OpenAI?

Major funders are Microsoft, SoftBank (leading $40 billion round), Dragoneer ($2.8 billion), Thrive Capital, Sequoia Capital, and Founders Fund across multiple rounds.

How is OpenAI funded?

OpenAI receives funding through equity investments in private rounds. These amount to about $58-64 billion across 11 rounds. Additionally, OpenAI leverages debt and forms strategic partnerships, like with Microsoft.

How will OpenAI make money?

OpenAI plans to expand revenue through more subscriptions. They will increase API usage and incorporate ads/shopping in ChatGPT. Enterprise licensing will also be introduced. They aim to scale to $200 billion by 2030, despite high costs.

How does OpenAI make money if its free?

Basic ChatGPT is free to attract users. But revenue comes from paid tiers (Plus, Team, Enterprise), API calls billed per token, and model licensing to businesses.

Where did OpenAI get funding?

Funding sources include venture firms like SoftBank and Sequoia, and Microsoft. Sovereign wealth funds are targeted for future rounds. Early donors include individuals like Elon Musk and Peter Thiel.

How much money OpenAI spent on ChatGPT?

ChatGPT running costs are about $100,000 daily ($3 million monthly) on GPUs. The GPT-4 base development costs over $100 million in training compute.

How much money OpenAI lost?

OpenAI reported $5 billion loss on $3.7 billion revenue in 2024; H1 2025 net loss $13.5 billion; projected $14 billion loss in 2026.

How much money OpenAI has?

OpenAI holds about $17.5 billion in cash/securities (Q2 2025), with total raised exceeding $64 billion supporting operations.

How to put money into OpenAI?

Direct investment is unavailable to the public. Accredited investors may access it through VC funds holding OpenAI stakes. Alternatively, they can invest indirectly via Microsoft or Nvidia stock.

What is OpenAI Startup Fund?

The OpenAI Startup Fund was launched in 2021 with $100 million. It expanded to $175 million. The fund invests in early-stage AI startups that are tackling global challenges.

How much is OpenAI worth?

OpenAI’s valuation reached $500 billion in 2025 tender offers, with talks for $750-830 billion in a potential $100 billion round.

How much funding did OpenAI receive?

OpenAI has raised $57.9-63.9 billion total across 11 rounds, including a record $40 billion Series F in March 2025 led by SoftBank.

Is OpenAI public traded company?

No, OpenAI remains privately held with no IPO filed; it’s a hybrid capped-profit under nonprofit control.

Is OpenAI free?

Basic ChatGPT access is free with limits; advanced features, API usage, and premium models require paid subscriptions or per-token billing.

Is OpenAI in financial trouble?

Yes, reports show high cash burn ($14 billion projected loss 2026, $20 billion shortfall), risking crunch points despite fundraising efforts.

Is OpenAI funded by Microsoft?

Yes, Microsoft has invested over $13 billion since 2019 and is a key partner hosting on Azure.

Is OpenAI open source?

No, OpenAI’s core models like GPT-4 are proprietary; it released some older/open models but shifted to closed for competitive/safety reasons.

When was OpenAI last funding round?

Latest closed round: $40 billion Series F in March 2025 (fully funded by Dec 2025); SoftBank added $22.5 billion Dec 2025.

Is OpenAI non profit?

Originally nonprofit (2015); now hybrid with for-profit subsidiary (capped-profit PBC) controlled by nonprofit board.

Can you buy OpenAI stock?

No direct stock acquisition as it’s private; indirect via public partners like Microsoft or AI ETFs/VC funds for accredited investors.

What series of funding is OpenAI?

Current at Series F ($40 billion, March 2025); prior included Seed ($100M, 2015), Series A ($1B).

When is OpenAI next funding round?

Reportedly targeting $100 billion round by Q1 2026 end, valuing at $750-830 billion, seeking sovereign wealth funds.

Is Microsoft funding OpenAI?

Yes, Microsoft continues funding via partnership investments exceeding $13 billion.

How many rounds of funding has OpenAI had?

OpenAI has completed 11 funding rounds as of March 2025.

.

.

About Merrative

At Merrative, we aim to build a collective of writers, analysts, scholars, and journalists to create and discuss thought-provoking content.

We aim to create a one-stop place to access human expertise to publish thought leadership content — starting with newsletters.

Founder Leverage is one of our portfolio newsletters, along with AppliedAI Trends, Media First Brand, and ReadTreats. Based on your content strategy, we can help you publish below 4 types of newsletter formats:

- Case Studies Newsletter – Breaks down real wins and success stories to demonstrate authority.

- Data Stories Newsletter – Turns industry data and trends into clear, actionable insights.

- Industry Expert Interview Newsletter – Extracts frameworks and lessons from expert conversations.

- Content Curation Newsletter – Curates the most important ideas with takeaways and links so readers don’t have to.

Leave a comment